Generation Breakdown: Why I (and maybe you) Can’t Afford a Mortgage ’til 2028

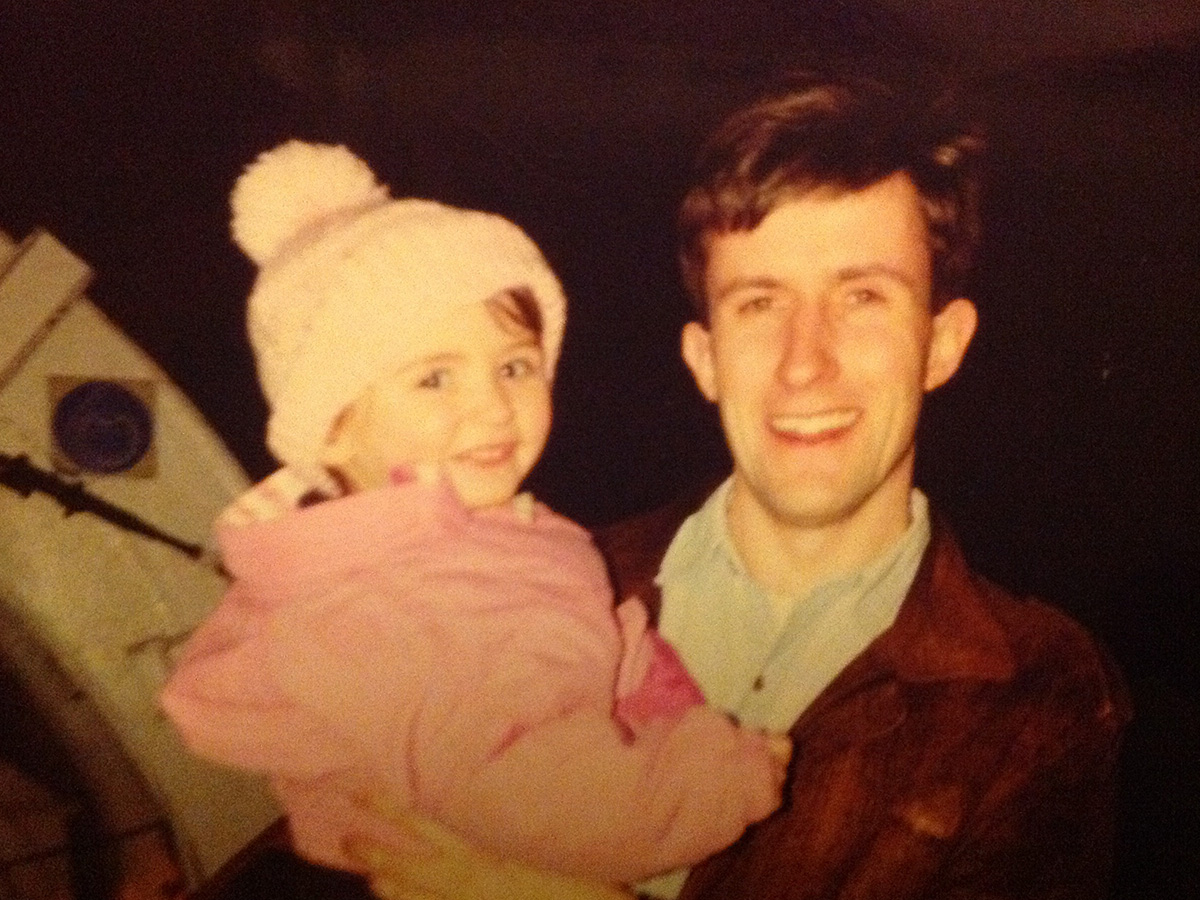

Copyright: David Jones (my dad)

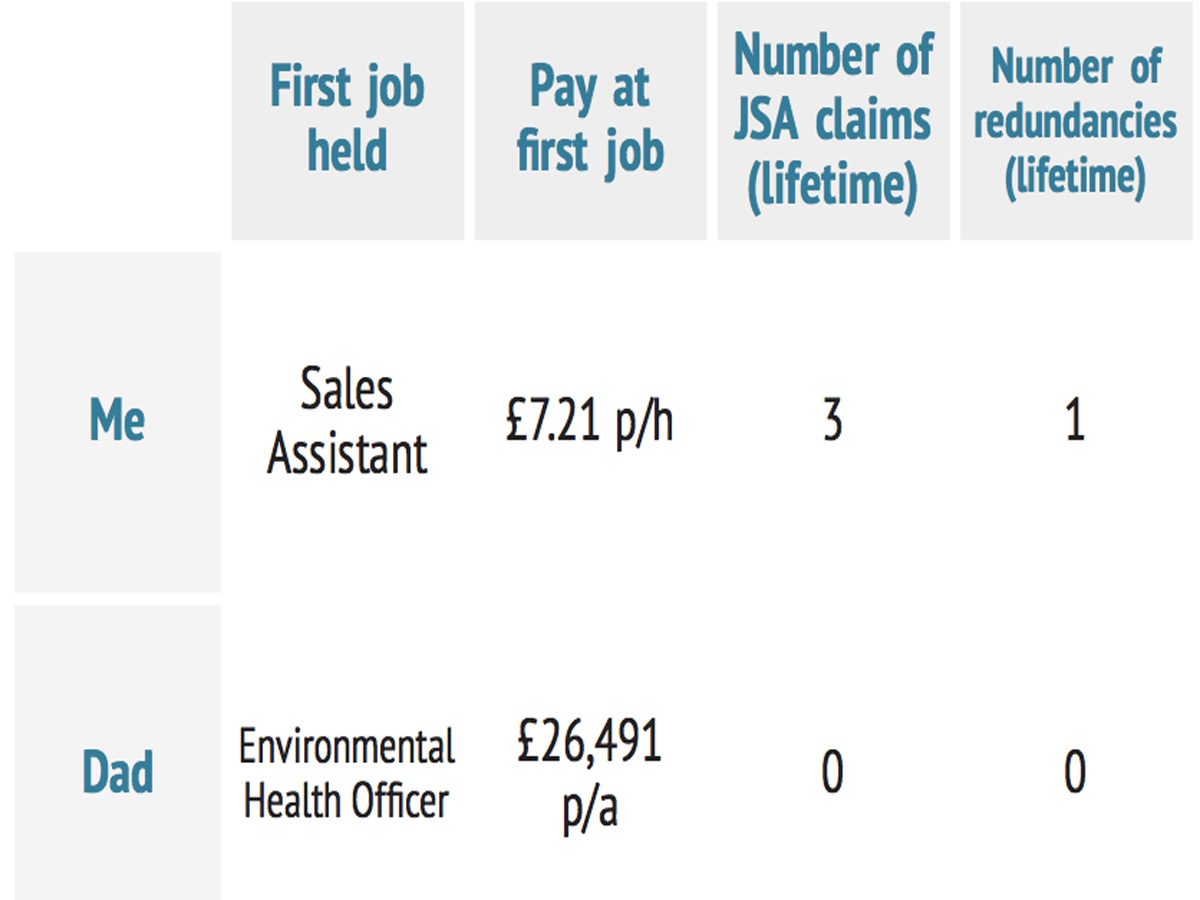

Sammy Jones, like Britain, needs a payrise. Because by her age, her dad was earning twice what she is, had a house and no student debt. Is that fair?

Have you sat down to look at your finances lately? If you’re anything like me, the phrases ‘bank statement’, ‘fixed rate’ and ‘investment account’ strike the fear of god deep into your heart. With house prices, university prices, everything prices stacking up, it’s becoming easier than ever before to leave your banking app getting cobwebbed and dusty on the very last page of your home screen.

…the economic landscape our parents graduated into was much better, and how we under-30s are losing out on jobs…

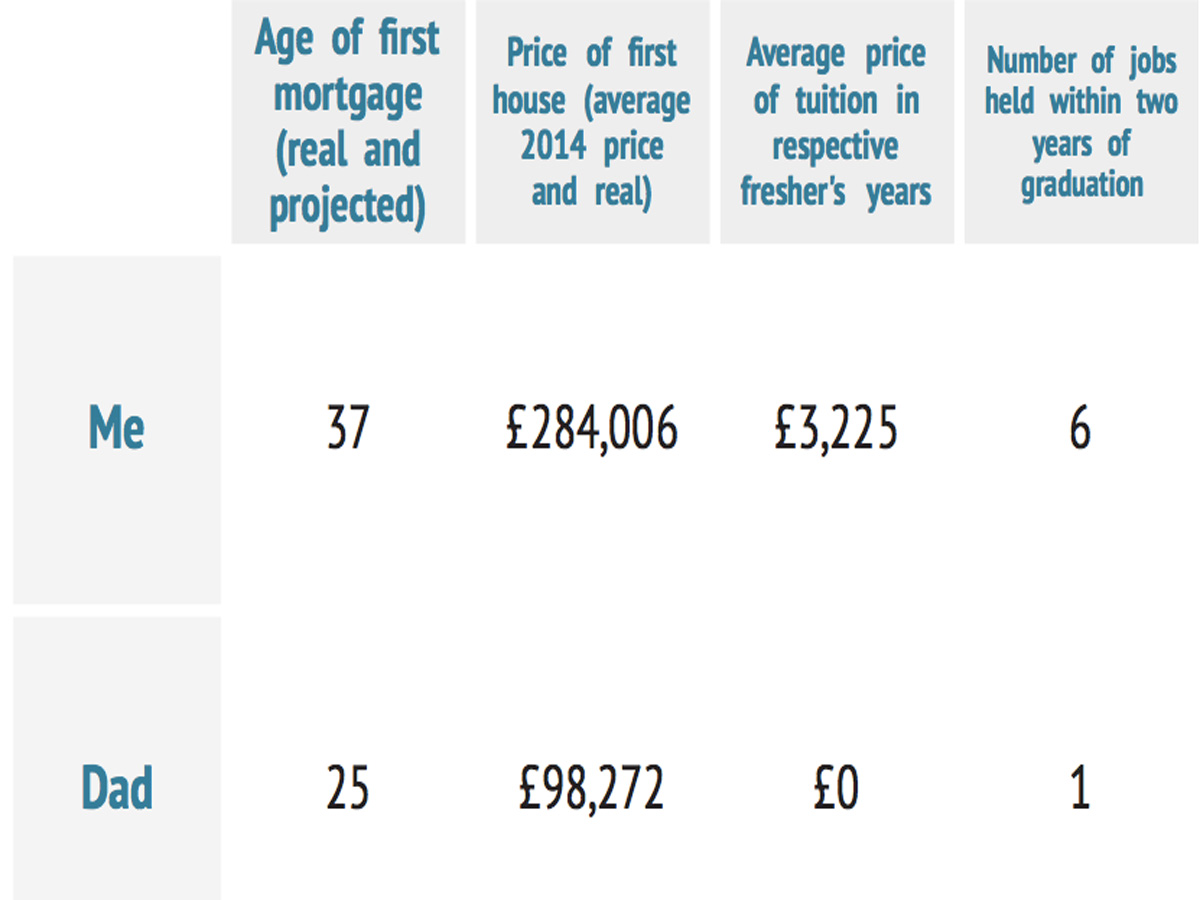

But has it always been like this? Last time I sat down to do some depressing maths (also known as budgeting for the month) I remembered I’d read something on the The Guardian about how the economic landscape our parents graduated into was much better, and how we under-30s are losing out on jobs, earnings and housing. With this in mind, I interviewed my dad about how his life after university panned out in comparison to mine. The results are HILARIOUS. That’s why there’s tears in my eyes, right?  Within six months of graduation, my dad had managed to get a well-paid permanent job (as THE ONLY applicant), a mortgage (which was very much the norm amongst his friends) and a new car (bought on 0% finance, handed over by the bank without question).

Within six months of graduation, my dad had managed to get a well-paid permanent job (as THE ONLY applicant), a mortgage (which was very much the norm amongst his friends) and a new car (bought on 0% finance, handed over by the bank without question).

When my dad got a job, he stayed there.

I, on the other hand, have managed none of the above, and not from lack of trying. When my dad got a job, he stayed there. For me, it’s been a bit of a scramble since uni finished – I’ve worked in offices, bars, and gone freelance. I’ve pitched creative ideas, poured pints and hustled from home. The longest job I’ve held down was ten months long. That job wasn’t promised at the end of my internship there, either. After that ten months, I got made redundant, leaving me ever-so-slightly shell-shocked. I went on the dole, I got a job at a bar, and I got a job at a supermarket. Oh, and I did some writing on the side. I would love to have some job stability, if only to get on the housing ladder. But that’s a whole other story…

When I think about getting a mortgage on a house, it feels like something that doesn’t really apply to me.

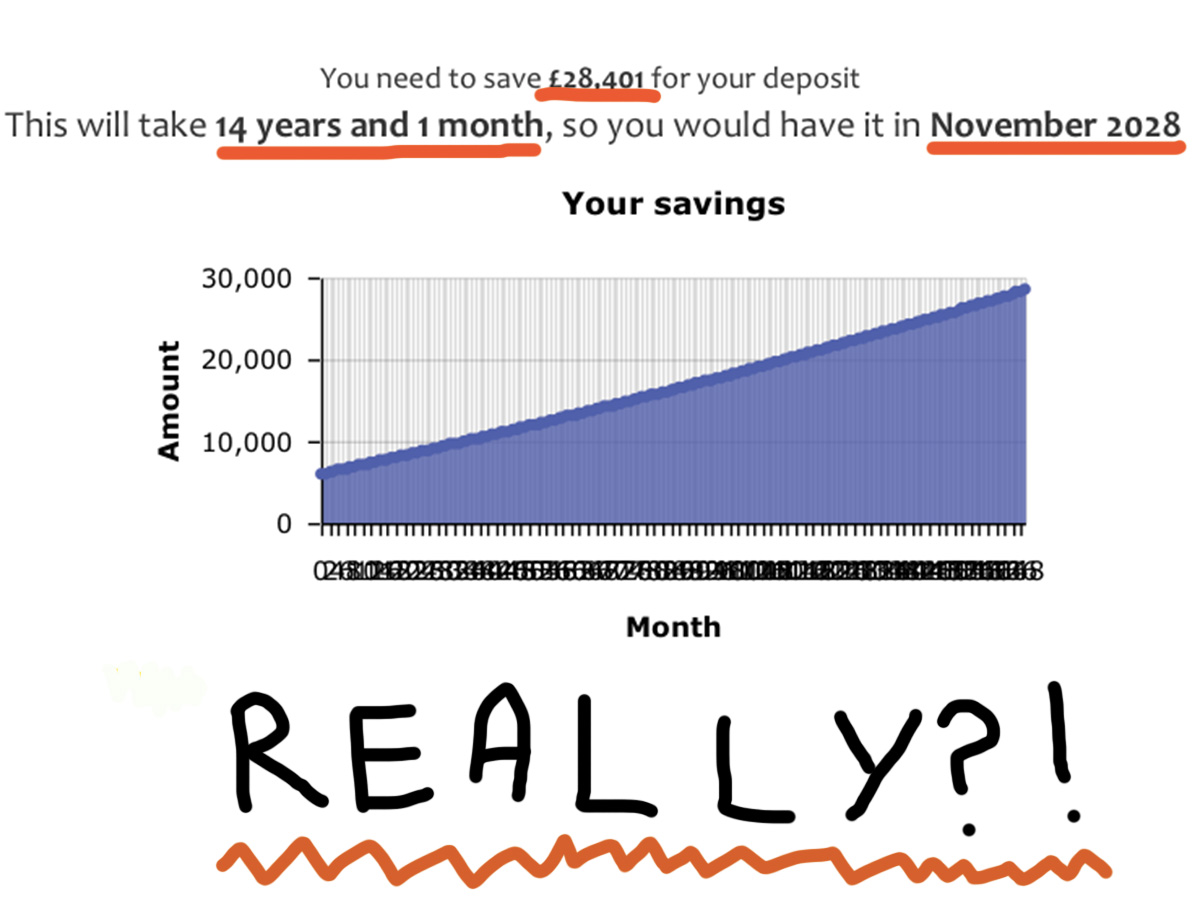

When I think about getting a mortgage on a house, it feels like something that doesn’t really apply to me. None of my friends have one either so I don’t THINK I’m doing life wrong. Despite a feeling of foreboding deep in my stomach, I thought it would be worth checking how long it would take me to save for a deposit. I knew it wouldn’t be pretty, but I didn’t think it would take me 14 YEARS. 37 feels very old compared to my dad’s 25. He’s had a 12-year start on me. And with people living longer than ever before, that housing equity is going to be locked up a lot longer than it would have been for generations before.

Job opportunities afforded to the generations before us just aren’t as accessible when companies start to hit the dust.

So what on earth is going on? According to Alan Milburn, the former Labour cabinet minister who chairs the government’s Commission on Social Mobility, under-30s were the worst hit by our country’s recession. Job opportunities afforded to the generations before us just aren’t as accessible when companies start to hit the dust. ‘Last-one-in, first-one-out’ mentality sets in, unpaid internships are everywhere, and there just aren’t the resources to train up new team members. Desperate times mean desperate measures, and young people without jobs are living with their parents longer than ever before and when they do move out it’s a struggle to keep up with bills, tax and having enough to live off by the end of the month.

So to recap: I’m poor, you’re probably poor, and we’re going to be in the same sinking ship for a while. It upsets me when I think about how my life plans might be pushed back because of all this. I had a vague idea of going back to university at one point, but that’s completely financially unviable, and I should probably be on the property ladder within the next few years rather than flushing away my cash into the Great Toilet of Rented Flats, but there’s absolutely no chance. I’m fed up and hard up, and I sort of wish I’d been born in the 60s. Do you?

Come on, talk Sammy down from that tall building by letting her know if you’re pretty much dead broke too. You can get hold of her on our Twitter, Facebook and her personal Twitter

All ‘Dad’ prices recorded from 1988 and adjusted in line with inflation to 2014 levels using the Bank of England’s inflation calculator Average house price data taken from Rightmove for the South West in October 2014 Projected mortgage age calculated using Money Saving Expert’s deposit calculator

Related links:

‘To Vote… Always to Vote’ by Huw James ‘Depression amongst the Jobless’ by Adibah Iqbal